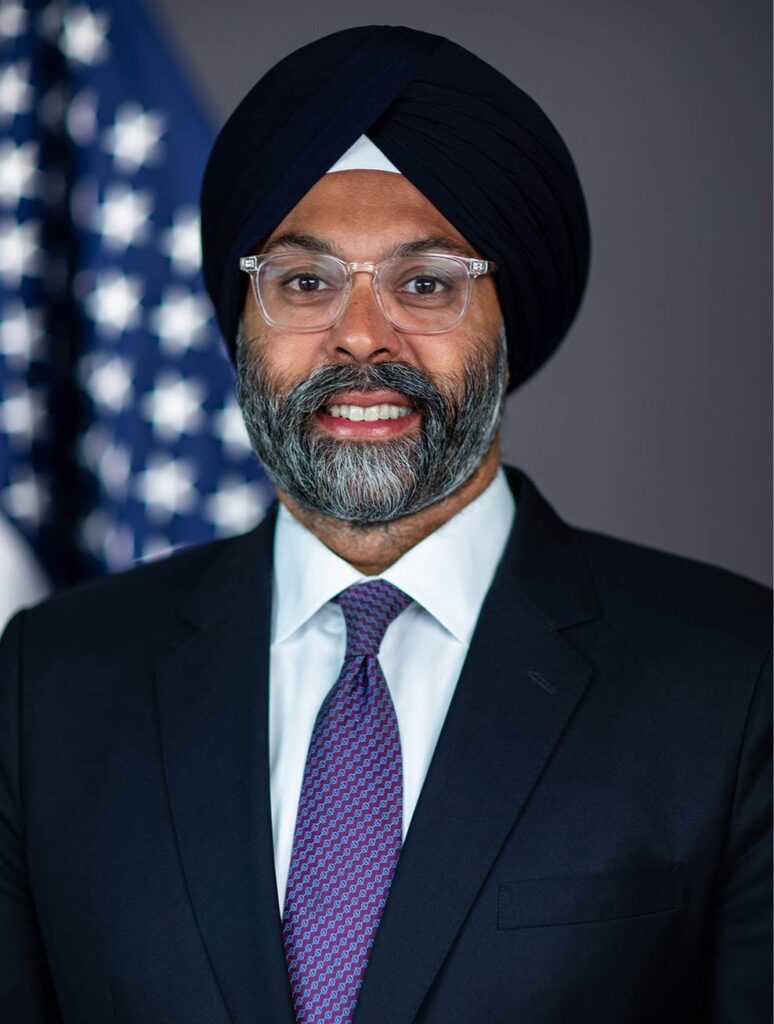

SEC Enforcement Division chief Gurbir Grewal, who reinvigorated the SEC’s enforcement effort and pushed for stricter enforcement and higher penalties as part of an effort to clean up messy public perceptions about the investment industry, will leave the SEC Oct. 11.

During Grewal’s three years with the agency, the SEC’s Enforcement Division carried off more than 2.400 enforcement efforts, resulting in more than $20bln in disgorgement, civil penalties, and interest payments. It also paid more than $1bln to whistleblowers and barred 340 players from involvement in the investment industry, according to an Oct. 2 SEC announcement of Grewal’s departure.

Grewal “prioritized restoring investor trust and confidence in the financial markets by emphasizing proactive enforcement initiatives and working to create a culture of compliance among market participants,” according to the release, in which SEC chair Gary Gensler praised Grewal’s effort to “protect investors and help ensure market participants comply with our time-tested securities laws.”

Those enforcement actions included more than 100 focused on crypto companies, increased the number of prosecutions of traders using inside information, brought the first successful prosecutions for insider trading of shares in a peer company rather than the perpetrator’s own, and brought actions against fraud in block trading.

Under Grewal the Enforcement Division also brought down audit firm BF Borgers for fraud involving more than 1,500 SEC filings, which the announcement described as one of the largest wholesale failures by a gatekeeper in the history of the SEC. It also charged audit firm Prager Metis for negligence in auditIng crypto firm FTX and for violating auditor independence requirements.

Grewal also focused the division’s enforcement efforts on problems involving broker-dealers, investment advisers, credit-rating agencies, especially when they involved industry recordkeeping processes that had become less strict than the agency considered proper. Among the highest-profile of those efforts is the SEC’s ongoing crusade against investment companies that fail to prevent employees from talking shop over private text- and chat applications rather than via in-channel methods that record such discussions in formats that make it easier for SEC Examinations and Enforcement staff to evaluate later.

Grewal’s aggressive stance – especially when enforcing Gensler’s high priority on enforcement of securities laws involving crypto firms – gained neither Gensler nor Grewal many friends in the crypto industry or in Congress.

Grewal “Encouraged lawlessness and chaos at @GaryGensler’s SEC,” House Majority Whip Tommer Emmer (R – Minn.) tweeted Wednesday after the announcement was posted, “Good to see him packing his bags.”

Grewal pushed back on both crypto companies and their fans by insisting during public appearances that critics of the SEC’s crypto policies were upset primarily because of the SEC’s refusal to “give crypto a pass” on rules that applied to every other registered company.

SEC Commissioners Hester Peirce and Mark Uyeda opposed the standoff on crypto, but also opposed the aggressive enforcement of recordkeeping and off-channel communications problems, primarily because rules covering those activities reflect the technology available when they were passed in 1997, not the current state of the art.

Rather than enforcing obsolete rules, the two have argued that the SEC should have done more to update regulations to match current technology to counter a situation in which “even well-intentioned firms could find themselves in the Commission’s enforcement queue time and again,” according to an Oct. 1 Morgan Lewis analysis of the SEC’s most recent off-channel messaging enforcement actions.

“From recalibrating penalties and remedies to confronting emerging risks to holding issuers, insiders, and gatekeepers accountable, I am incredibly proud of all that we’ve accomplished as a Division during my tenure,” Grewal said in the release, which gave no reason for Grewal’s departure or his future plans. Grewal came to the SEC in July 2021 after serving as attorney general for the State of New Jersey from January, 2019 through June 2021; he previously held the post of prosecutor for Bergen County, New Jersey’s most populous county.

The release did make a point of saying that the agency’s Enforcement Division would continue to pursue the same priorities after his departure Oct. 11 under the supervision of Enforcement Division deputy director Sanjay Wadhwa, who will take over as acting director until a permanent replacement is found, and the division’s chief Counsel Sam Waldon, who will serve as acting deputy director.

Industry dubious on SEC mantra that self reporting shrinks penalties

SEC insiders: Don’t self report, don’t ask SEC too many questions

Exams, Enforcement lists show 2024 SEC priorities may differ from 2023

Gensler defends enforcement, says penalties dropped $1.4bn in 2023