The SEC’s latest enforcement-actions report offers solid evidence of the SEC’s priorities during the past year, but may not help fund directors trying to figure out how to bulletproof their compliance efforts, especially on controversial issues, including ESG.

The report released Nov. 15 shows a big drop in the financial penalties the SEC levied during fiscal 2023, but does not indicate any softening of the agency’s approach to enforcement, SEC chair Gary Gensler said during an appearance Oct. 25 at the Securities Enforcement Forum in Washington D.C.

The $4.95bn the SEC levied during fiscal 2023 was far below the record $6.4bn it posted during FY2022, but the number of enforcement actions also rose to 784 during FY2023 – 3% higher than the total of 764 actions during 2022.

That included 501 “stand-alone” enforcement actions – an 8% increase compared to last year – and 162 follow-on administrative proceedings, after which the SEC barred 133 people from serving as officers or directors or from practicing before the SEC or association bars. During his speech in October, Gensler called that number “our highest in a decade.”

Penalties included $3.37bn in disgorgement and prejudgement interest and $1.58bn in civil penalties – both the second-highest totals on record, according to the SEC announcement. The SEC also distributed $930m to investors and set a new record by paying nearly $600m in awards to whistleblowers.

It also set records for the highest award paid to one whistleblower ($279m) and for 18,000+ whistleblower tips it received during the year – beating the then-record 12,300 tips it received during 2022 by 46%.

It also touted its ability to spot problems without the help of whistleblowers, showing the SEC’s ability to analyze data in registrant filings and other methods, such as the data-gathering sweep by the Division of Examinations that resulted in $850,000 in penalties levied in September against nine investment advisers accused of advertising hypothetical performance numbers on their web sites.

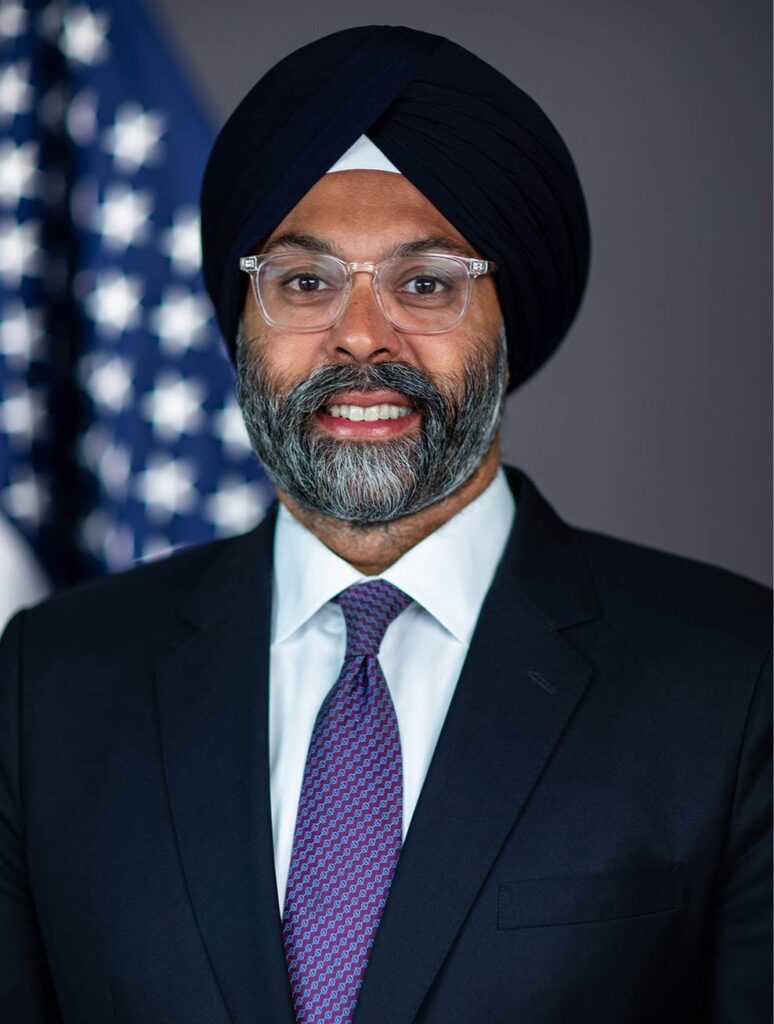

The agency reported coming down hard on fraud, especially among crypto providers, which Division of Enforcement director Gurbir S. Grewal described during an appearance June 16 as posing a “perfect storm of investor risk.”

Most of the charges the SEC presents are handled administratively or settled before they’re announced, but more than 40% of standalone matters during fiscal 2023 involved litigation against companies or individuals.

SEC remains focused on RIAs

The SEC continues to pay close attention to investment advisers and investment companies, though the 18% of enforcement actions aimed at those companies is down a few percentage points from previous years, according to a Nov. 20 analysis by law firm Proskauer Rose LLP.

The Proskauer report also found that the SEC focused very closely during 2023 on high-profile enforcement of comparatively small-scale violations it considers “misconduct that undermines its effective oversight of the securities industry.”

As in 2022, those housekeeping violations included sloppy recordkeeping, reporting and a large number of actions involving the failure to restrict business conversations to email and other monitored media, rather than personal text, WhatsApp and other unregistered media.

The SEC makes enforcement of those violations as visible as possible by doing things like bundling the announcement of many settlements into larger packages.

Among the most visible were settlements with 25 advisory firms, broker-dealers, credit-rating companies and others, including Wells Fargo, HSBC, Robert W. Baird & Co., Nuveen Securities and Scotia Capital that paid a total of $400 million over charges that they’d violated recordkeeping requirements.

In both cases, Grewal said in the announcement of the settlements, penalties were far smaller than they might have been during 2022 because the firms involved identified the problems and reported them.

“If you adopt that playbook, you’ll have a better outcome than if you wait for us to come calling,” Grewal said in the announcement of $289m worth of those settlements in August.

ESG drops off list, but not from SEC priorities

The SEC is and will continue to focus on issues relating to ESG-branded funds or investment products as well, as it did in the March 2023 settlement with mining company Vale, which the SEC accused of making false and misleading claims about the safety of its dams before a January 2019 dam collapse in Brazil that killed 270, Grewal said during an appearance at the Berkeley Fall Forum on Corporate Governance (video available here).

Other than the Names Rule, which addresses faulty naming of all funds, not just those related to ESG, the SEC has not finalized any rules directly attempting to regulate ESG investing, however. Attempts by the SEC, Dept. of Labor and other federal agencies to introduce rules governing the use of ESG terminology or requiring disclosure of climate-risk data face tremendous opposition from various affected industries, from officials responsible for government-employee-pension funds, and from Republican and Democratic members of Congress.

ESG-related issues featured prominently in the list of priorities the SEC’s Division of Examinations published in 2022 but were conspicuously absent in the version the division published Oct. 16.

Fees, expenses and derivatives risk-management assessments figure prominently in the 2024 version, but the section on investment advisers focuses more on processes to eliminate potential conflicts of interest, including board oversight of those conflicts.

Examiners will also look closely at marketing practices, which include enforcement of existing rules that address ESG greenwashing issues from a truth-in-advertising perspective, Gensler has said in repeated defenses of the SEC’s stance on ESG regulation.

Omitting specific mention of ESG – and other controversial issues, including swing pricing and oversight of third-party service providers – doesn’t mean those won’t also be hot-button issues.

Fund boards and fund advisers will need to be aware of the issues underlying high-profile SEC rule proposals, even if they have not yet been finalized, “as the SEC takes steps to enforce the new rules and the principles it has espoused in its rulemaking,” the Proskauer report concluded.

• Marketing practice assessments [of whether advisers have] adopted and implemented reasonably designed written policies;

• and procedures to prevent violations of the Advisers Act and …reforms to the Marketing Rule;

• Compensation arrangement assessments focusing on fiduciary obligations of advisers to their clients;

• Valuation assessments regarding advisers’ recommendations to clients to invest in illiquid or difficult to value assets;

• Safeguarding assessments for advisers’ controls to protect clients’ material non-public information;

• Disclosure assessments to review the accuracy and completeness of regulatory filings;